Chinese firms out in force at world’s biggest health care meet, even as country’s tech companies cool on US

-

About 38 Chinese privately-owned and listed companies are attending the JPMorgan Healthcare Conference in San Francisco

-

Attendance contrasts with 20 per cent decline in number of Chinese firms at annual CES consumer electronics trade show

Eric Ng

Published: 7:01pm, 10 Jan, 2019

Updated: 9:30pm, 10 Jan, 2019

Eric Ng joined South China Morning Post in 1998 after brief stints in a trading company and translation and editing roles at Dow Jones and Edinburgh Financial Publishing. He has close to 20 years of experience covering China’s energy, mining and industrial materials sectors, and has recently added biotechnology to his coverage. Eric has a master’s of business administration degree.

More Chinese companies have flocked to this year’s JPMorgan Healthcare Conference, the industry’s largest investment symposium in the world, defying a steep slump in stock valuations in the sector and wider economic and political worries.

About 38 Chinese privately-owned and listed companies – an increase of 22.6 per cent over last year – have made presentations and attended one-on-one meetings at the event, which runs Monday through Thursday this week in San Francisco. Thirty-one firms attended the event last year, and 21 in 2017.

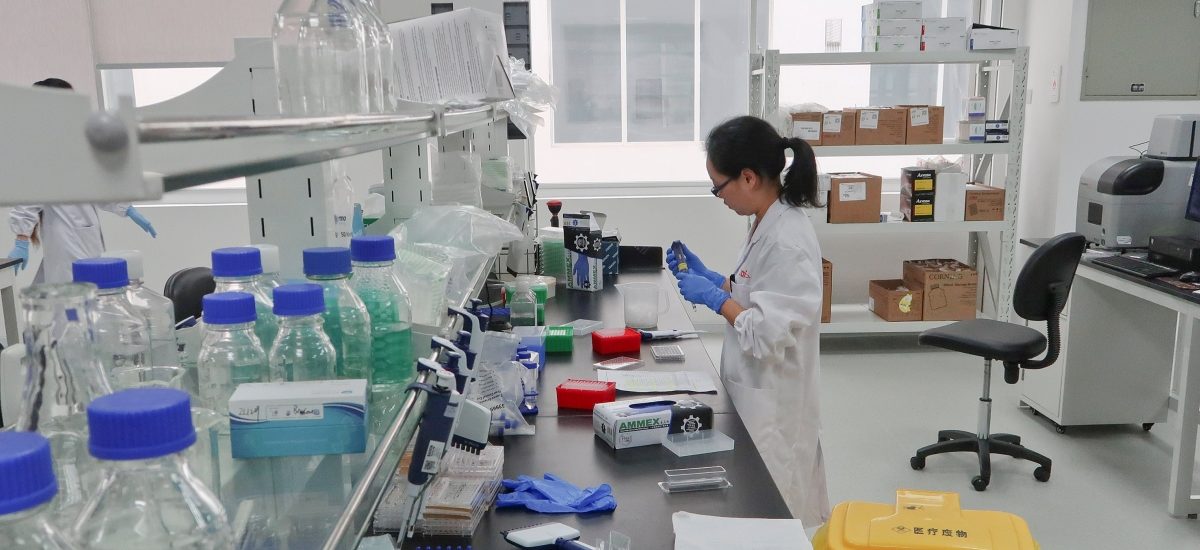

These companies include innovative drug developers, generic drug manufacturers, medical devices companies, online pharmacy and health care services platform operators, as well as outsourced manufacturing and clinical trial services providers. They are eager to share their investment stories and business updates with new and existing investors, as well as potential technology licensing and marketing partners from the United States and elsewhere.

The rising number of Chinese companies presenting at the invitation-only event signifies their coming of age, and contrasts with a 20 per cent decline in the number of Chinese firms registered to attend the annual CES consumer electronics trade show

, the world’s biggest technology and consumer electronics exhibition, also being held this week in Las Vegas.

The rising numbers also vindicate a move by Hong Kong to allow listings by pre-revenue biotechnology companies in April last year. Five such firms have listed on the mainboard of its stock exchange so far.

“China’s drug development has witnessed revolutionary and globally rare changes in the three years to 2018, resulting in over 40 new drugs being approved last year alone, compared to four in the 50 years to 2008,” Song Ruilin, president of the China Pharmaceutical Innovation and Research Development Association, told a panel discussion on Wednesday.

Frank Zhang Fangliang, chairman of chimeric antigen receptor T-cell (CAR-T) cancer therapies developer Genscript Biotech, told a panel: “Nowadays, the regulatory environment is almost the same as in the US … in the CAR-T area, China ranks just behind the US and is ahead of Europe and Japan in terms of the number of clinical trials. In some new segments, Chinese firms can be just as innovative as US firms.”

Many Chinese venture capital and private equity firms are also attending the conference with the aim of finding investment targets in the US, which has the world’s biggest and most innovative biotechnology and pharmaceutical industry.

These firms poured about US$4.5 billion into US biopharma companies last year in 85 deals, up from US$3 billion in 44 deals in 2017, according to Silicon Valley Bank, which has helped fund more than 30,000 start-ups, primarily in technology industries.

“China, historically being the destination of capital, has increasingly become the [originator] of capital,” Charles Li Xiaojia, chief executive of bourse operator Hong Kong Exchanges and Clearing and a former JPMorgan Asia chairman, who pushed hard for reform to allow pre-revenue biotechnology IPOs in Hong Kong, told a panel discussion on Monday.